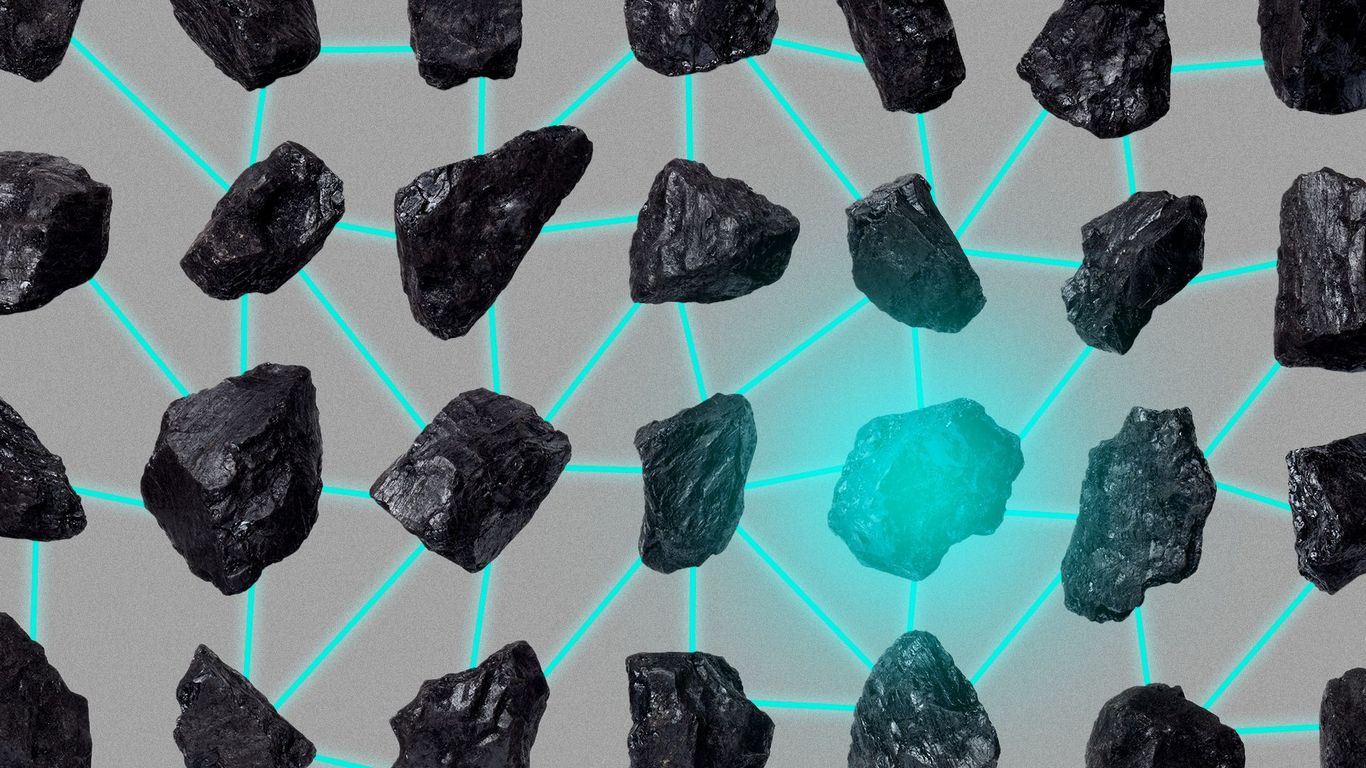

The International Finance Corporation is partnering with a handful of startups on a $10 million fund to invest in carbon credits and resell them on a blockchain.

Why is this important: Treating carbon credits like traditional financial assets could strengthen the nascent carbon market.

To note : Aspiration, a fintech startup, and Cultivo, a project finance startup, will primarily manage the $10 million Carbon Opportunity Fund with backing and backing from IFC and blockchain startup Chia Network.

How it works: The fund will invest in so-called nature-based carbon capture projects, where carbon is extracted from the air through natural means such as reforestation or algae cultivation.

- Projects generate verified carbon credits which the Carbon Opportunities Fund can then sell to businesses and financial institutions, and use the profits to reinvest in the fund to support larger projects down the road.

- Steve Glickman, Global President at Aspiration, says Axios that the fund will invest in up to 700,000 metric tons of carbon credits in the first year.

- “The more they are seen as assets, the more people will seek investment in the projects to access credits,” Glickman says of the Fund’s long-term goal.

State of play: The carbon market has remained a headache for large financial institutions and companies looking to meet their ESG commitments or offset their emissions.

- Carbon credits are difficult to verify and can vary in value due to lack of standardization in the market.

- Some investors have argued that the credits allow big companies to carve their way to net-zero goals instead of taking meaningful steps to change the dirtiest aspects of their business.