Japanese trade finance market

Dublin, June 29, 2022 (GLOBE NEWSWIRE) — The report “Japan Trade Finance Market (2022-2027) by Product Type, Service Provider, Application, Competitive Analysis and the Impact of Covid-19 with Ansoff Analysis” has been added to from ResearchAndMarkets.com offer.

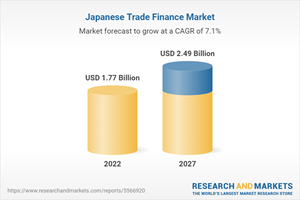

The Japanese trade finance market is estimated at USD 1.77 billion in 2022 and is projected to reach USD 2.49 billion by 2027, growing at a CAGR of 7.09%.

Report Highlights:

-

A comprehensive analysis of the market, including the parent industry

-

Important market dynamics and trends

-

Market segmentation

-

Historical, current and projected market size based on value and volume

-

Market shares and strategies of the main players

-

Recommendations for companies to strengthen their presence in the market

Market segmentation

-

The Japanese trade finance market is segmented on the basis of product type, service provider and application.

-

By product type, the market is categorized into commercial letters of credit, stand-by letters of credit, guarantees, and others.

-

Service provider, the market is categorized into banks, trade finance houses, and others.

-

Application, the market is classified into domestic and international.

Key players

-

Asian Development Bank.

-

Bank of America

-

BNP Paribas

-

Euler Hermes

-

JP Morgan Chase & Co.

-

Mitsubishi UFJ Financial Group, Inc.

-

Royal Bank of Scotland Plc

-

Standard charter

-

Mizuho Financial Group

-

Standard charter

-

Sumitomo Mitsui Banking Corporation

-

Morgan Stanley

-

Wells Fargo & Co.

Ansoff analysis

The report presents a detailed analysis of the Ansoff matrix for the Japanese trade finance market. Ansoff Matrix, also known as Product/Market Expansion Grid, is a strategic tool used to design business growth strategies. The matrix can be used to assess approaches in four strategies viz. Market development, market penetration, product development and diversification. The matrix is also used for risk analysis to understand the risk associated with each approach.

Main topics covered:

1 Description of the report

2 Research methodology

3 Executive summary

4 Market dynamics

4.1 Drivers

4.1.1 Increase in the number of trade agreements

4.1.2 Banks and financial agencies improving their trade facilitation programs

4.1.3 Growing digitization of financial services

4.2 Constraints

4.2.1 Strict compliance with regulations and financial crime

4.2.2 High implementation cost

4.3 Opportunities

4.3.1 Integrating blockchain into trade finance

4.3.2 Implications of government initiatives on trade

4.4 Challenges

4.4.1 Credit Constraints

4.4.2 Complexity of trade finance transactions

5 Market Analysis

5.1 Regulatory scenario

5.2 Porter’s Five Forces Analysis

5.3 Impact of COVID-19

5.4 Ansoff matrix analysis

6 Japan Trade Finance Market, by Product Type

6.1 Presentation

6.2 Commercial letters of credit

6.3 Stand-by letters of credit

6.4 Warranties

6.5 Other

7 Japan Trade Finance Market, by Service Provider

7.1 Presentation

7.2 Banks

7.3 Trade Finance Houses

7.4 Others

8 Japan Trade Finance Market, by Application

8.1 Presentation

8.2 Domestic

8.3 Internationals

9 Competitive landscape

9.1 Competitive Quadrant

9.2 Market Share Analysis

9.3 Strategic Initiatives

9.3.1 Mergers and Acquisitions and Investments

9.3.2 Partnerships and collaborations

9.3.3 Product developments and improvements

For more information about this report, visit https://www.researchandmarkets.com/r/ss885p

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood, Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900