A look at the shareholders of Power Finance Corporation Limited (NSE:PFC) can tell us which group is the most powerful. Insiders often own a large portion of younger, smaller companies, while larger companies tend to have institutions as shareholders. Companies that have been privatized tend to have low insider ownership.

Power Finance is a pretty big company. It has a market capitalization of ₹289b. Normally, institutions own a significant share of a business of this size. In the graph below, we can see that the institutions own shares in the company. Let’s take a closer look at what different types of shareholders can tell us about Power Finance.

Check out our latest analysis for Power Finance

What does institutional ownership tell us about energy financing?

Many institutions measure their performance against an index that approximates the local market. So they usually pay more attention to companies that are included in major indices.

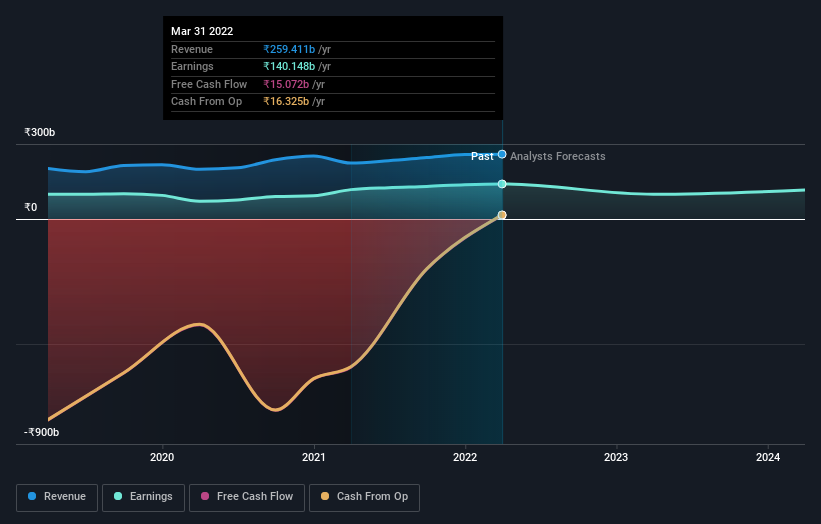

We can see that Power Finance has institutional investors; and they own a good part of the shares of the company. This may indicate that the company has some degree of credibility in the investment community. However, it is best to be wary of relying on the so-called validation that accompanies institutional investors. They are also sometimes wrong. When multiple institutions hold a stock, there is always a risk that they are in a “crowded trade”. When such a transaction goes wrong, multiple parties may compete to quickly sell shares. This risk is higher in a company with no history of growth. You can see Power Finance’s historic earnings and revenue below, but keep in mind there’s always more to tell.

Power Finance is not a hedge fund. Our data shows that India is the largest shareholder with 56% of outstanding shares. This implies that they have majority control over the future of the company. With respectively 8.7% and 5.1% of the outstanding shares, HDFC Asset Management Company Limited and Life Insurance Corporation of India, Asset Management Arm are the second and third largest shareholders.

Institutional ownership research is a good way to assess and filter the expected performance of a stock. The same can be obtained by studying the feelings of the analyst. There is a little analyst coverage of the stock, but not much. So there is room for him to gain coverage.

Energy Finance Insider Ownership

The definition of an insider may differ slightly from country to country, but board members still matter. The management of the company answers to the board of directors and the latter must represent the interests of the shareholders. In particular, sometimes the senior executives themselves sit on the board of directors.

Insider ownership is positive when it signals that executives think like the true owners of the company. However, strong insider ownership can also give immense power to a small group within the company. This can be negative in certain circumstances.

Our most recent data indicates that insiders own less than 1% of Power Finance Corporation Limited. It’s a big company, so even a small proportionate interest can create alignment between the board and shareholders. In this case, insiders own 6.7 million shares. It’s good to see board members owning stock, but it can be helpful to check whether those insiders have bought.

General public property

The general public, including retail investors, owns 11% of the company’s capital and therefore cannot be easily ignored. Although this group may not necessarily make the decisions, they can certainly have a real influence on the way the business is run.

Next steps:

While it is worth considering the different groups that own a business, there are other, even more important factors. Take risks for example – Power Finance has 3 warning signs (and 2 that make us uncomfortable) that we think you should know about.

But finally it’s the future, not the past, that will determine the success of the owners of this business. Therefore, we think it’s advisable to take a look at this free report showing whether analysts are predicting a brighter future.

NB: The figures in this article are calculated using trailing twelve month data, which refers to the 12 month period ending on the last day of the month in which the financial statements are dated. This may not be consistent with the annual report figures for the full year.

Feedback on this article? Concerned about content? Get in touch with us directly. You can also email the editorial team (at) Simplywallst.com.

This Simply Wall St article is general in nature. We provide commentary based on historical data and analyst forecasts only using unbiased methodology and our articles are not intended to be financial advice. It is not a recommendation to buy or sell stocks and does not take into account your objectives or financial situation. Our goal is to bring you targeted long-term analysis based on fundamental data. Note that our analysis may not take into account the latest announcements from price-sensitive companies or qualitative materials. Simply Wall St has no position in the stocks mentioned.